Submitted by Dave Collum via PeakProsperity,

A downloadable pdf of the full article is available here, for those who prefer to do their power-reading offline.

Background: The Author

“The easiest thing to do on earth is not write.”

~William Goldman, novelist

I never would have believed it—not in a million years—but it happened: the Cubs won the World Series, and The Donald is our new president. Every December, I write a Year in Review1 that’s first posted on Chris Martenson’s & Adam Taggart’s website Peak Prosperity2 and later at Zero Hedge.3 What started as a few thoughts posted to a handful of wingnuts on Doug Noland’s Prudent Bear message board has mutated into a detailed account of the year’s events. Why write this beast? For me, it puts the seemingly disconnected events that pass through my consciousness, soon to be lost forever, into a more organized and durable form. Somebody said I should write a book. I just did. In a nutshell, this is a story of human follies and bizarre events. There are always plenty of those. Let others tell the feel-good stories.

![]()

Figure 1. Malcolm McDowell as Alex in A Clockwork Orange.

I try to identify themes that evolve. This year’s theme was obviously defined by the election, which posed a real problem. I struggled to detect the signals through the noise. Many of my favorite analysts from whom I extract wisdom and pinch cool ideas spent the year trying to convince the world that one or more of the presidential candidates was an unspeakable wretch. I was groping for a metaphor to capture our shared experiences, rummaging through Quentin Tarantino scripts and Hieronymus Bosch landscapes for inspiration. “Rise of the Deplorables” was tempting. Then it clicked. The term “clockwork orange” is a Cockney phrase indicating a bizarre incident that appears normal on the surface. The phrase was commandeered as the title of a 1971 dystopian film in which Malcolm McDowell’s character Alex is brainwashed by being forced to watch the most grisly and horrifying of spectacles (Figure 1). For us, it was the 2016 presidential election, which created a global mind-purging brain enema. The horror! The horror! (Oops. Wrong movie.)

I knew in January that by mid-November we would be unified by our collective distrust of the Leader of the Free World, who would be surrounded by a dozen chalk outlines corresponding to political corpses that nobody wished to resurrect. I have done my best to not marinate you—too much—in tales of sociopathic felons or stumpy-fingered, combed-over letches. I do, however, eventually enter the Swamp.

By way of introduction, my lack of credentials—I am an organic chemist—has not precluded cameos in the Wall Street Journal,4 the Guardian,5Russia Today,6,7,8 a plethora of podcasts,1 and even a couple investment conference talks. Casting any pretense of humble bragging aside, let’s just post this year’s elevator résumé and a few endorsements to talk my book.

“We live in a world where some of the best commentary on the global financial markets comes from a frustrated chemistry professor.”

~Catherine Austin Fitts, former Assistant Secretary of Housing, former Dillon, Reed & Co., and current president of Solari9

One of the high-water marks was sharing the spotlight with Mark Cuban in a Wall Street Journal article by Ben Eisen on nouveau gold buggery:10

“Dave Collum . . . has been adding to his holdings of physical gold this month, citing, among his concerns, negative interest rates and the growing refugee crisis in Europe. ‘I’m getting apocalyptic,’ he said.”

~Ben Eisen, Wall Street Journal

Podcasts in 2016 included Wall St. for Main St.,11Macro Tourist Hour (BTFD.TV),12The Kunstlercast,13Five Good Questions,14FXStreet,15 and, of course, Peak Prosperity.16 Dorsey Kindler, of a small-town newspaper, the Intelligencer (Doylestown, PA), interviewed me about college in an article titled, “The New McCarthyism” and, in an ironic twist, was soon thereafter fired and his content purged.1 An interview for the Cornell Review, a right-wing student newspaper considered a “rag” by the liberal elite, probed college life and the new activism.17 A cross-posting at Zero Hedge got the Review’s click counts soaring.18 Finally, I chatted on local radio about real estate, the bond market, Hillary, and other rapidly depreciating assets.19

“If you reflect on Prof. Collum’s annual [review], you will realize how far removed from the real world and markets you are. This is a huge deficiency that all of you must work on correcting.”

~Professor Steve Hanke, economist at Johns Hopkins University, in a letter to his students

Contents

Footnotes appear as superscripts with hyperlinks in the Links section. The whole beast can be downloaded as a single PDF xxhere or viewed in parts via the linked contents as follows:

Part 1

Part 2

For historical reasons, the review begins with a survey of my perennial efforts to fight the Fed. I am a fan of the Austrian business cycle theory and remain hunkered down in a cash-rich and hard-asset-laden Bunker of Doom (portfolio). The bulk of the review, however, is really not about bulls versus bears but rather human folly. The links are as comprehensive as time allows. Some are flagged as “must see,” which is true only for the most compulsive readers. The quote porn is voluminous: I like capturing people’s thoughts in their own voices while they do the intellectual heavy lifting.

I try to avoid themes covered amply in previous reviews. Some topics resolve themselves. Actually, none ever do, but they do get boring after a while. Others reappear with little warning. Owing largely to central banking largesse, the system is so displaced from equilibrium that something simply has to give, but I say that every year. We seem to remain on the cusp of a recession and the third, and hopefully final, leg of a secular bear market that began in 2000. Overt interventions have kept the walking dead walking. The bulls call the bears Chicken Littles and remind us what didn’t happen. One of my favorite gurus reminds us of a subtle linguistic distinction:

“Didn’t is not the same as hasn’t.”

~Grant Williams, RealVision and Vulpes Investment Management

I finish with synopses of books I’ve read this year. They are not all great, but my limited bandwidth demands selectivity . They are all nonfiction (to varying degrees). I don’t have time to waste on 50 Shades of Garbage.

Sources

“As for the national press corps—the Fourth Estate—it has been compromised, its credibility crippled, as some of the greatest of the press institutions have nakedly shilled for the regime candidate, while others have been exposed as propagandists or corrupt collaborators posturing as objective reporters.”

~Pat Buchanan, syndicated columnist and senior advisor to presidents

With some notable exceptions, the mainstream media has degenerated into a steaming heap of detritus that is so bad now that it gets its own section. A congenital infobesity has morphed into late-stage disinfobesity. Enter social media—the fever swamp—to fill the void. As we shall see, however, all is not well there either. I sift and pan, looking for shiny nuggets of content that reach the high standards of a rant. Shout-outs to bloggers would have to include Michael Krieger, Charles Hugh Smith, Peter Boockvar, Bill Fleckenstein, Doug Noland, Jesse Felder, Tony Greer, Mike Lebowitz, Mish Shedlock, Charles Hugh Smith, and Grant Williams. News consolidators and new-era media include Contra Corner,20Real Vision,21Heatstreet,22 and Automatic Earth.23 A carefully honed Twitter feed is a window to the world and the road to perdition. My actions speak to my enthusiasm for Chris Martenson and Adam Taggart at Peak Prosperity.24 However, if you gave me one lens through which to view the world, I would have to choose Zero Hedge (or maybe LadySonya.com).

“You really should be keeping a journal because you are living through momentous times.”

~Chris Martenson, Peak Prosperity

On Conspiracy Theorizing

“I stopped believing in coincidences this year.”

~Scott Adams, creator of Dilbert

Every year I shout out to conspiracy theorists around the world. I am not talking about abductions by almond-eyed aliens with weaponized anal probes (which really hurt, I hasten to add) but rather the simple notion that sociopathic men and women of wealth and power conspire. Folks who could get through 2016 without realizing this are imbeciles. I am talking totally blithering idiots. Markets are rigged. Government stats are cooked. Interest rates are set by fiat. Polls are skewed. E-mails are destroyed. Cover-ups abound. Everybody has an agenda. Watch this d-bag at one of the neocon think tanks—somehow so stupid as to not realize he’s being recorded—talk about how false-flag operations are commonplace.25 Meanwhile, the media conspires to convince us to the contrary. The folks who really piss me off, however, are the glib intellectuals—Nassim Taleb calls them “intellectuals yet idiots” (IYIs)—who suggest that conspiracy theorists are total ret*rds.26 (Saved by the asterisk, which baffles the sh*t outta me why that works.) Does it seem odd that the world’s most prominent detractor of conspiracy loons, Harvardian Cass Sunstein,27 is married to neocon Samantha Power,28 one of the great conspirers? It does to me, but I am susceptible to such dietrologie.

“Popular opinions, on subjects not palpable to sense, are often true, but seldom or never the whole truth.”

~John Stuart Mill

![]()

Many will try to shut down open discussions of ideas displaced from the norm by using the word “conspiracy” pejoratively. Their desire for the world to be normal is an oddly child-like cognitive dissonance. In that event, lean over and whisper in their ears, “Keep your cognitive dissonance to yourself, dickweed” while gently nudging them in the groin with your knee. Now, let’s pop a few Tic Tacs, grab a clowder, and get on with the plot, but first . . .

*Trigger Warning* If this review is already too raw for your sensibilities, please stop reading. Nobody is making you squander your time on a socially marginal tome of questionable merit. Better yet, seek professional help.

Investing

“If you pay well above the historical mean for assets, you will get returns well below the historical mean.”

~Paraphrased John Hussman

Read that over and over until you understand it. Changes in my 2016 portfolio were more abrupt than those from other years but still incremental. I resumed purchasing physical gold in 2015 after a decade-long hiatus. In 2016, I bought aggressively in January (the equivalent of half an annual salary) and continued incremental buying throughout the year (another half salary). My total tonnage (OK, poundage) increased by an additional 5% of my assets. My cash position shrunk by about 5% accordingly but remains my largest holding. I am in no rush to alter the cash position. For a dozen years, I have been splitting my retirement contributions into equal portions cash and natural gas equities. The latter keeps failing to attain an approximate percentage goal of 25–30% of my assets owing to market forces. My approximate positions are as follows:

Precious metals etc.: 27%

Energy: 12%

Cash equivalent (short term): 53%

Standard equities: 8%

The S&P, despite a late year rally incorrectly attributed to the Trump victory, appears to be running on fumes or, as the big guns say, is topping. The smart guys (hedge fund managers) continue to underperform, which means the dumb money must be overachieving (blind nuts finding squirrels). This is never a good sign.

“We should all own cash, because it is the most hated asset.”

~Jim Rogers, Rogers Holdings and Beeland Interests

“The great financial success stories are people who had cash to buy at the bottom.”

~Russell Napier, author of Anatomy of the Great Bear (2007)

“Cash combined with courage in a time of crisis is priceless.”

~Warren Buffett, Berkshire Hathaway

![]()

Figure 2. Performances of GLD, SLV, XAU, XLE, XNG, and S&P.

After a few years of underperformance resulting from the oil and gold drubbing, large gains in the gold equities (60%), gold (6%), silver (15%), generalized energy equities (10%), and natural gas equities (48%) shown in Figure 2 were attenuated by the huge cash position to produce a net overall gain in net worth of 9%. This compares to the S&P 500 (+10% thanks to a hellacious late year rally) and Berkshire Hathaway (25%, wow). (Before you start brain shaming me, that same cash buffer precluded serious percentage losses during the hard-asset beatings in the preceding years.)

The most disappointing feature of the year was in the category of personal savings. I have managed net savings every year, including those that included paying for college educations. This year, however, began poorly when my gold dealer got robbed and lost my gold. My losses paled in comparison to his; he committed suicide. I discovered maintenance needs on my house that got really outta control, and a boomerang adult child ended up costing me a bit. All told, I forked over 50% of my annual salary to these unforseeables, which turned overall savings negative (–20% of my salary) and eroded a still-decent annual gain in net worth. Oh well, at least I have my health. Just kidding. I have a 4 centimeter aortic aneurysm, am pissing sand, and have mutated into Halfsquatch owing to congenital lymphedema (Figure 3). (I live-Tweeted a cystoscopy—likely a first for social media.) I have to keep moving here to finish before I pass my expiration date.

Figure 3. Sand and Stump.

In a longer-term view, large gains in total net worth (>300%) since January 1, 2000 are still fine. I remain a nervous secular precious metal bull and confident equity secular bear. I intend to put the cash to work when Tobin’s Q, price-to-GDP, price-to-book, and Shiller PE regress to and through the mean. When this will occur is anybody’s guess, especially with central bankers determined to make me pay for “fighting the Fed.” I will start buying after a 40% correction brings the S&P to fair value, keep buying as it drops below fair value, and wish I had saved my money by the secular bottom. We return to all this in Broken Markets.

Here’s what my dad taught me: you need cash at the bottom to buy up cheap assets. Few will have cash because you have to go to cash at the top, and precious few have the capacity to shake recency bias and exit positions that have performed well. Just like a toaster, your sell order has only two settings: too soon and too late. My far greater concern is that bear markets are as much about time as they are about inflation-adjusted price. The Fed is determined to burn the clock. Nobody wins if we imitate Japan’s 25-year lost decade.

“Time takes everybody out. It’s undefeated.”

~Rocky Balboa

U.S. Economy

“The word ‘maximum employment’ has this connotation that everything is good in the labor market, but everything is not great in the labor market.”

~Loretta Mester, president of the Cleveland Federal Reserve

Unemployment is at 4.9%—what’s not to like? Economists have even claimed the “labor market is getting tight.” I scoff. The labor participation rate shows that 38% of working-age adults are not working (Figure 4). Apparently, 33% of working-age adults are neither employed nor unemployed. Hmmm . . . even that’s a little optimistic given that only 50% of adults are employed full-time. The millennials are getting whacked by the boomers who refuse to die (sorry, retire).

![]()

Figure 4. Unemployment (left; official stats in red; Shadowstats in blue) and labor force participation rate (right).

The wealth for middle-class households has dropped 30% since 2000;29 One in five kids lives in poverty,30 46 million folks are on food stamps;31 20% of the families have nobody employed32 (despite the 4.9% number); and almost 50% of all 25-year-olds are living with mom and dad unable to translate that self-exploration major into a job.33 Half of all American workers make less than $30,000 a year.34 The once-industrial-juggernaut Rochester of Kodak/Xerox fame has more than 30% of residents living in poverty and another 30% living with government assistance.35 Very Detroit-like but without the Aleppo motif.

You can see it in the micro if you drill down. Deindustrialization has been occurring steadily since the late 90s.36 The mining industry lost more this year than it made in the last eight years.37 Sales of industrial-strength trucks have been “dropping precipitously.”38 Sales in general are looking very ’09-ish. Factory orders and freight shipping (Cass Freight Index) have been dropping for two years.39 Catherine Mann of the OECD says that “In terms of actual trade growth, it is extremely grim.” The CEO of Caterpillar finally cashed in his chips after 45 contiguous months of dropping sales.40 Commercial bankruptcies are up 38% year over year,41 whereas 62% of Americans have less than $1,000 in savings.42 It seems unlikely the consumer will be buying bulldozers and 18 wheelers in the near future.

“This turns out to be the deepest and most protracted growth shortfall on record for the modern-day global economy.”

~Stephen Roach, Yale professor and former chairman and chief economist at Morgan Stanley

The economy is in the weakest post-recession recovery in half a century despite protestations to the contrary by Team Obama.43 The 2%-ish growth rate since ‘09 feels like a recession, especially given specious inflation adjustments to get 2%. There isn’t a wave of job cuts yet, but some signs are worrisome. Cisco Systems laid off 20% of its workforce.44 GE cut 6,500 jobs.45 Despite gains in non-GAAP earnings, GE’s GAAP earnings—the non-fabricated earnings—plunged.46 Intel dumped 11% of its workforce but faked a win by dropping its assumed tax rate by 7%.47 This tactic smacks of the same old financial engineering, but maybe it is headed for nonprofit status. One bright spot: the $15 billion vibrator industry is set to grow to $50 billion,48 satisfying consumers in a manufacturing–service industry combo.

Speaking of stimulus, what the hell went awry? The Feds drilled the rates to zero (creating a ginormous bond bubble; vide infra) to encourage consumers to do the one thing they cannot afford to do—consume. Global central bankers have cut rates every 3 days since 2008 according to Grant Williams.49 The central bankers dumped tens of trillions of dollars—trillions with a “t” that comes right before gazillions with a “g”—into the global economy. The answer is simple and foreshadowed above: once you blow up a credit bubble, you cannot force consumers to spend. Have ya heard people talking about pulling equity out of their houses lately? Didn’t think so. That numbnut idea proferred by the incoherent Alan Greenspan left consumers with the same houses and twice the debt while poverty-stricken old age looms large.

“If a consumer buys a boat today with money made available through a low-interest loan, that’s a boat he won’t buy next year.”

~Howard Marks, Oaktree Capital and Three Comma Club (billionaire)

“The decline of the middle class is causing even more economic damage than we realized.”

~Larry Summers, speaking for himself with the royal “we”

How could the economists have been so wrong? I have a remarkably simple theory: their models are wrong. They suffer so badly from Friedrich Hayek’s “fatal conceit” that they have become functional nitwits. That’s the best I’ve got. One could argue we have a secular economic problem. As a nation, we exploited cheap labor overseas through immigration during the 16th–20th centuries. The immigrants worked like dogs, got paid squat, and saved so furiously that it became a lot more than squat. Thomas Sowell explains this brilliantly in his writings.50 For the last few decades, however, we exploited cheap overseas labor by exporting jobs. They too worked like dogs, got paid squat, and saved furiously. But that wealth is not here; it’s over there (pointing east). Will new and improved trade policies solve our (U.S.) problems? I don’t think so. As long as there are folks overseas willing to work harder for less, we have some correcting left to do. With that said, I am a free-trade guy and particularly like the trade agreement painstakingly crafted by Mish Shedlock:

“Effective immediately, all tariffs and subsidies, on all goods and services, are removed.”

~Mish Shedlock (@MishGEA), blogger

How about some more Keynesianism? Former economist Paul Krugman, whose op-eds read like episodes of Drunk History, would say we simply haven’t done enough. (Paul: you have done more than enough.) Modern-day Keynesianism has mutated way past Maynard’s original idea into an unrecognizable metaphysical glob of thinking that boils down to the notion that government knows how to spend better than the private sector does. Is this the same government that included Anthony Weiner, Rick Santorum, and Barbara Boxer?

Here is Keynesianism I could live with. Government should spend as little as possible, but there are legitimate roles to be played. Imagine if governments at all levels would simply act like financially interested parties—as a collective, not as slovenly greedy, bribery-prone individuals—and buy necessary goods and services when they are cheap and stop buying when the private sector has bid them up. We would get maximum bang for the tax buck. It would also quite naturally achieve the much ballyhooed counter-cyclicality. But, alas, the moment they start talking “stimulus,” the pay-to-play crowd turns it into a fiasco. As my dad once said, “Never ask government to do anything they don’t have to do, because they will do a terrible job.” Words from the wise.

Broken Markets

“I don’t think a single trader can tell you what the appropriate price of an asset he buys is, if you take out all this central bank intervention.”

~Axel Weber, former head of the Bundesbank

“My thesis now is that central banks believe they can prop up asset prices through a downturn in the business cycle.”

~@TheEuchre

Whomever @TheEuchre is, I think that is a provocative alternative theory of Fed motivation. Moving along, we seemed to be on the cusp of a recession last year with a number of valuation indicators pointing to a +40% correction simply to regress to the mean. In the absence of such a correction (check) and the absence of explosive growth (check), we are still looking over the precipice (check). Luminaries like Stanley Druckenmiller, George Soros, Sam Zell, and Bill Gross are calling for a zombie apocalypse at some unknowable future date. Paul Tudor Jones appears to be wrapping up in a way that smacks of Julian Robertson’s Tiger Management hedge fund liquidation in ’99. Harvard’s Martin Feldstein says asset prices are “dramatically out of line.” Credit Suisse sees analogies to the tech bubble, whereas Ned Davis Research suggests, “on a revenue basis, U.S. stocks are as expensive as they have ever been.” Chart guru Doug Short created a simple model that averages four common equity valuation techniques (Figure 5). Based on his analysis, the market is 76% overvalued compared with the average dating back to 1900. (Note: a 76% overvaluation is regressed to the mean by a 43% correction, which will be as pleasant as baptizing a cat.)

![]()

Figure 5. Doug Short composite valuation model.

At these valuations, a few shanks at the start of the year were scary, but soon the markets entered the tightest 40-day trading range (2.27%) in more than 100 years—the Horse Latitudes.51 There were a few goofy IPO crack-ups but they stayed subclinical. Even flash crashes raised only a few eyebrows. Knee-slappers elsewhere included a crash of the British pound in the forex markets in under a minute owing to Brexiteers52 (vide infra) and a 6.7% crash in China in less than a minute.53 The misnamed Trump rally—misnamed because it began three days before the election—left some serious skid marks, elevating the market 8% in only a few weeks. This was a short squeeze in conjunction with . . . I don’t really know.

It is suggested that central banks and programmed investing have pushed a wall of money at the markets. This credit-based splooge corresponds to debts to be paid back later, but who cares? Over 10,000 mutual funds and exchange-traded funds (ETFs) are feeding off only 2,800 issues on the NYSE. There are now almost twice as many hedge funds as there are Taco Bells54 (which won’t be growing under a Trump presidency). I get a little confused as reported outflows in both equity funds and money market funds argue the contrary. (Even these claims are confusing given that buyers necessarily match sellers; vide infra.)

“[I]t’s monetary policy we demonstrate is driving everything. And yet here too, there are worrying signs of what may become a breakdown.”

~Matt King, Citigroup

Stock buybacks—in many cases leveraged stock buybacks—continue to levitate the markets. For those not paying attention, companies borrow money to buy back shares to prop up share prices, which serves the dual role of maximizing year-end bonuses and wards off balance sheet crises. Now my head hurts. Baker Hughes announced a $1.5 billion share buyback and $1 billion of debt issue. In the first half of 2016, S&P 500 companies “returned” 112% of their earnings through buybacks and dividends.55 Returned? There is some evidence that buybacks may be subsiding. When they stop buying shares at all-time highs—“buying high”—and their investment unwinds while crushing corporate debt persists, companies will be doing “dilutive share issuance” at fire sale prices—“selling low.” For now, corporate balance sheets hold the dumb money.

“The corporate sector today is stuck in a vicious cycle of earnings management, questionable allocation of capital, low productivity, declining margins and growing indebtedness.”

~Stanley Druckenmiller, former head of Duquesne Capital and rock star

There are instances of generic idiocy emblematic of deep problems. Eighty-five percent of traders on Wall Street have less than 15 years of experience. Synthetic securitizations are returning.56 Are buyers being paid for the risk? Some have suggested that retail investors should stay away from these (and Fukushima). A managed futures fund was launched by a 17-year-old kid who may not have made it to third base yet.57 A 28-year-old Ukrainian hacker got caught making over $30 million on insider information.58 If he were a bank, he’d have been fined $100K. The “head” of the collapsed Visium Asset Management hedge fund killed himself by slicing his own neck.59 Right. Platinum Partners appears to have been running a Ponzi scheme.60 Vegan food start-up Hampton Creek used $90 million in “seed” money to buy its own products (probably seeds) to generate fake “organic growth.”61 Nintendo spiked on the release of Pokémon, which caused hoards of idiots to chase digital critters to stupid places.62 Even though Nintendo fessed up that their bottom line would not be improved by the craze, some of the gains have stuck as investors keep chasing those digital share prices to stupid places.

“Markets don’t have a purpose any more—they just reflect whatever central planners want them to. Why wouldn’t it lead to the biggest collapse? My strategy doesn’t require that I’m right about the likelihood of that scenario. Logic dictates to me that it’s inevitable.”

~Mark Spitznagel, Universa Investments

Cash on the Sidelines

“Preliminary attempts to clean it up fail as they only transfer the mess elsewhere.”

~Wikipedia on the bathtub ring in The Cat in the Hat

In 2011, I used that quote in a different context, but it is a great articulation of the Law of Conservation of Mass.63 There are a lot of memes in the investing community—pithy phrases and ideas for which tangible support is weak or nonexistent. One is the merits of “cash on the sidelines” and its kissing cousin, money “flowing” in and out of asset classes. In the late ‘90s, I tried to ascertain how much cash was generated in sell-offs and soon realized the answer was zero. Others such as Lance Roberts,64 John Hussman,65 Cliff Asness,66 and Mish Shedlock67 have dismembered putty-headed thinking underlying cash on the sidelines. However, there are pockets of holdouts (mostly on CNBC) who subscribe to the flow model. You can hear Maria saying it: “There is so much cash on the sidelines waiting to go into equities.” I am going to take one last crack at it with the aid of some graphical wizardry and grotesque oversimplification.

“So if money is coming into the market, where is it going to find a home?…What’s going to get it into the market?”

~CNBC Fast Money

Here is the problem with the meme in a nutshell: If I buy, somebody must sell. It’s the Law of Conservation of Cash. If I grab a stack of Tubmans ($20 bills) and buy NFLX, the former owner of NFLX now has the Tubmans, and I have the overpriced shares. Do that all day long, and the cash on the sidelines doesn’t change; it moves around like the bathtub ring. Mutual funds insert middlemen to skim cash, but still no money is destroyed or created. Breathless claims that money is flowing in or out of mutual funds sounds important, but where in this model is cash created or destroyed? The percentage of cash, however, is a huge issue.

Let’s look at this graphically and restrict it to a simple binary model (Figure 6). Imagine there is $100 trillion in cash globally and $100 trillion of market cap in equities. Of course different investors have different allocations, but investors have collectively decided that they wish to own 50% cash and 50% equities (labeled 50:50).

![]()

Figure 6. Equity-to-cash allocations in a non-inflationary world.

In a non-inflationary banking system, the cash is static. Along comes legendary wise man John Bogle declaring equities reward risk taking, we should weight our portfolios 60:40, and the world agrees. Investors will bid up equities to higher valuations until, collectively, equities reach the 60:40 proportion for a satisfying 50% gain exclusively through expansion of the numerator. Legendary raging bull Laszlo Birinyi, guided by recency bias, convinces the world stocks are great investments and suggests 80:20 as the right allocation. Investors collectively agree, and they bid shares higher, which completes an overall 300% equity gain from the conservative days of 50:50 allocations. Now we’re rocking! We are just beginning to pull stupidity forward. Jeremy Siegel, self-appointed guru and demagogue, says you simply can’t lose, so you should be 90% stocks, and the world listens because this particular baitfish-smart analyst stays at Holiday Inns and is from Yale! The market has now lost all moorings, pushing the overall gains to 800%! Of course, now cash is trash and investors strive to be 100% in equities. Equity investors now “reach out and touch the face of God” because the prices are heading for infinity. Alas, The Bear appears before that can happen—it always does. It doesn’t have to be an axle-breaking speed bump. The proximate trigger is not important. Spooked investors drop their allocations back to 60:40 and, in the depths of despair, back to 50:50. You will then scoop up cheap equities with inverted baggies from disembowled, toe-tagged investors who need cash.

We gave the gains all back . . . or did we? During this round trip, society collectively learned to make goods and provide services much more efficiently. The same amount of effort—the same amount of cash—corresponds to a much higher standard of living. This is good deflation, the kind that James Grant describes because he reads the dusty archives from bygone eras. Most economists nowadays endorse low inflation that roughly matches productivity growth, which causes both the cash and the market cap (equities) to drift gently upward in a feel-good money illusion.68

Don’t we need inflation for growth? Only if you believe the industrial revolution of the nineteenth and early twentieth century was disappointing. For the first half of the twentieth century, the DOW rose 1.3% nominally per annum. However, the modern banking system is most definitely inflationary. Money is created by increased leverage of all kinds—sovereign debt, consumer debt, quantitative easing (QE), and helicopter money all grow the money supply. They grow the denominator (cash) in Figure 6, which is inflation. The overarching model guiding the Fed’s policies seems to be that increasing the denominator will nonlinearly increase the numerator. As inflation lifts equities, animal spirits take hold (the Wealth Effect) and lift them even more. We will go through the four stages of bullishness: Bogle-Birinyi-Siegel-God. The gains will be illusory because real wealth is manufactured, farmed, mined, and maybe programmed. Central bankers will always do something; sitting on their hands (or thumbs) is unnatural. When the markets de-lever, however, cash leaves the system. Business and investing models demanding inflation begin to break. This is bad deflation. It is harsh, abrupt, and dreaded by central bankers, because it is largely their doing.

Pharma Phuckups

“If you think health care is expensive now, wait until you see what it costs when it’s free.”

~P. J. O’Rourke, conservative columnist

There seemed to be an epidemic of flatliners in the pharmaceutical industry requiring quarantine (its own section). The big one was Theranos, a company based on miraculously effective lab tests that turned out not to really work.69 The company was quietly outsourcing to labs whose tests did work. When the scam was revealed, the wunderkind CEO, Elizabeth Holmes, watched her Forbes-estimated net worth drop from $4.5 billion in 2015 to “$0” in 2016.70 The corporate digital exam would be familiar to her distant relative John Holmes.

Mylan suffered an optics problem when the disappearance of a key competitor allowed it to take a cue from pharma scoundrel Martin Shkreli71 and jack up its EpiPen price 500%,72 which smacked of price gouging. Mylan was protected by government intervention when Teva was denied rights to make a competing product.73 Such mischief in the generic drug market is real. The feds also mandated stocking EpiPens in all schools.73 A million bucks of lobbying money well spent.74

An ode to my new EpiPen

It used to cost one, now it’s ten

Our merchants of greed

Are cheeky indeed

These grifters are at it again

~@TheLimerickKing

Valeant Pharmaceuticals also reported big losses following big gains. Criminal investigations into Valeant took it 90% off its recent highs (a “tenth bagger”).75 Meanwhile, drug giant Eli Lilly’s share price Felt the Bern in the fall when Bernie Sanders tweeted concerns about the price of insulin rising 700% in 20 years.76 The big-cap drug scoundrels have also been accused of fabricating an ADHD epidemic and causing a global prescription drug addiction. A drum beat to restrain pain meds is getting very loud. Chronic pain patients watch with angst.

“Recovery is living long enough to die of something else.”

~Dr. Howard Wetsman (@addictiondocMD), chief medical officer, Townsend Addiction Treatment Centers

Oh, those bastards, right? Well, maybe not. I’m gonna take a crack at defending the industry. Mylan has been dead money for 20 years—zero percent return ex-dividends and ex-inflation. The same is true for Merck, Pfizer, Eli Lilly . . . I could go on. Former antimicrobial juggernauts Eli Lilly and Bristol-Myers Squibb are exiting the antibiotic market because they can’t pay the utility bills with the proceeds. You should worry.

“Drug corporations’ greed is unbelievable. Ariad has raised the price of a leukemia drug to almost $199,000 a year,”

~Bernie Sanders Tweet, dropping the shares 20% on the day

Where are all the revenues going? Really expensive research and development. Better meds make the world a better place. The life expectancies of AIDS patients with treatment are now three years below those of their uninfected peers. Wow. New-era cancer cures are off-the-charts effective. Pharma creates wealth in the purest sense and employs millions of people. On my consulting gigs, I can see researchers diligently trying to cure major diseases. Operationally, however, big-cap pharmas have been not-for-profit organizations for investors for several decades. When you see the prices get jacked up, don’t mindlessly assume it’s to line the pockets of management or investors.

It is claimed rather convincingly that the per-unit cost of health care has not risen, but the volume has soared. My stump/bladder sand /aneurysm mentioned above burned through a lot of health care. Why is health care so cheap elsewhere? My son broke his foot while in Vietnam weeks ago. X-rays, an MRI, surgery with titanium pins, and casting: $1,000. Three days in the hospital: $30 per day. Being invited to stay with the surgeon’s family for two weeks to convalesce: priceless. For a total of about $1,600, my son flew to Vietnam, got excellent surgery, and flew home. That is the essence of the rapidly growing medical tourism industry.

How is that possible? The doctor in Vietnam is not wealthy and probably demands few material goods. Torte reform is not needed because caveat emptor reigns. There might even be some Gates Foundation money thrown in. Most important, the profoundly expensive research and development was all done in developed countries and paid for by large revenue streams.

“It’s the craziest thing in the world.”

~Bill Clinton on Obamacare

Gold

“I am leaving the gold equity ‘buying opportunity of a lifetime’ . . . to others; my shrunken stash of equities is it for now. Maybe I just called the bottom.”

~David Collum, 2015 Year in Review

Nailed it! That was the bottom. I expect some checks in the mail from nouveau riche gold bugs who got 60% on their XAU-tracking investments. Despite weakness of late, the case for gold is now in place: European and Chinese banking risks, negative interest rates, a war on cash, and omnipresent risks of a hot war in the borderlands of the Middle East and Europe. Estimates suggest 0.3% of investors’ assets are in gold.77 Traditional portfolio theory recommends 5%, offering a better than 15-fold relative performance en route. (Recall that discussion of “flow” from above.)

Let’s check in on what some of the wingnuts on the fringe of society are chortling about now:

“The world’s central bankers are completely focused on debasing their currencies. If investor’s confidence in central bankers’ judgment continues to weaken, the effect on gold could be very powerful.”

~Paul Singer, Elliott Management Corp

Gillian Tett: “Do you think that gold is currently a good investment?

Greenspan: “Yes. Economists are good at equivocating, and, in this case, I did not equivocate.”

“I can understand why holding gold would seem to be a sensible part of a national portfolio. Because there is clearly a need to take some precautions against an unknowable future.”

~Mervyn King, former head of the Bank of England

“I am not selling gold.”

~Jeff Gundlach, DoubleLine and the new “Bond King”

“The case for gold is not as a hedge against monetary disorder, because we have monetary disorder, but rather an investment in monetary disorder.”

~James Grant, Founder of Grant’s Interest Rate Observer

“Everyone should be in gold.”

~Jose Canseco, expert on performance enhancement

James Grant also went on to say that “gold is like a monetary tonsil,” leading some to speculate that his son, Charley (WSJ), slipped him a pot brownie. Let’s see if we can get the goofs too.

We’ll begin by blowing out a few ideas I do not subscribe to. I keep hearing from smart guys that gold is in short supply in the Comex or Shanghai gold exchange, you name it. These stories almost never play out. I am also a huge fan of Rickards and Maloney, but the saying “gold is money” and the notion that its price is actually the movement of the value of the dollar don’t work for me: prices of everything I buy follow the dollar, not gold, on the currency timescales. On long timescales, their assertion may be correct. Someday their assertion may even be correct on short timescales, but that isn’t right now.

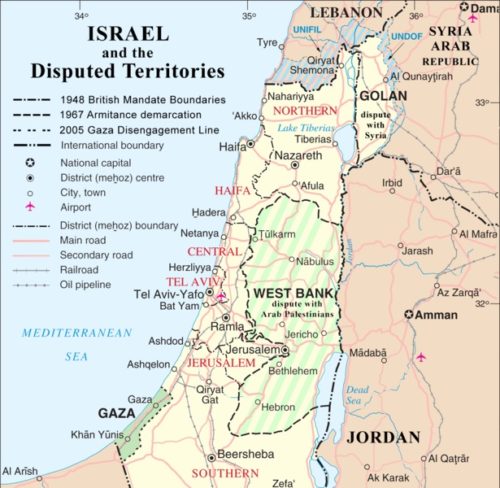

What a year: I got as many electoral delegates as the bottom ten republican candidates combined, ate python, and own as much gold as the Central Bank of Canada. Per the Bank of Canada, it finished selling off all of its gold,78 probably to ensure that the U.S. didn’t attack. You think I jest? A WikiLeaked e-mail by Sid Blumenthal to Hillary Clinton revealed that France whacked Libya to make sure North Africa distanced itself from a gold dinar currency.79,80 Germany supposedly has half of its requested gold repatriated from the U.S. and France,81 which could be bullish or bearish on the half-full/half-empty logic. Venezuela repatriated 100 tons of gold a few years ago and was squeezed to sell it all back in the heat of a currency crisis.82 The Dutch depatriated their gold this year after repatriating it not long ago.83 The reasons are unclear. Alexei Ulyukayev, first deputy chairman of Russia’s central bank, assured us Russia will continue to buy gold (Figure 7), presumably as a defense against interventions from inside the beltway. Of course, the Fed is silent on the “metal whose name shall never be spoken.”

![]()

Figure 7. Russian gold reserves.

In a shockingly quiet year given how much gold moved to the upside before the post-election monkey hammering, we probably should finish with some generic goofiness. On a few occasions, gold took the beatings that are familiar—huge futures dumps in the illiquid wee hours of the morning when no price-sensitive investor would ever consider selling. It dropped $30 in seconds late on the day before Thanksgiving when nobody was paying much attention. Another hammering came from a $2.25 billion sale84 and another $1.5 billion sale,85 both of which occurred in under 1 minute. Nanex concluded that the algo “gold spoofer” was at play,86 but the 2016 poundings were transitory and toothless compared with their brethren in 2011–2015. Trouble in the ETF market was revealed when BlackRock was overwhelmed by GLD buying.87 It was forced to create more shares in February than it had in a decade. I retain previously stated convictions that GLD is a scam—fractional-reserve gold banking. Deutsche Bank was overwhelmed by requests for physical gold.88 It tried to shake the hook by demanding that such a request must be made at a participating bank.89 Deutsche Bank, the location of the request, is not a participating bank? I imagine it doesn’t have the gold, consistent with its troubles outlined below. A Swedish precious metal vault got its payment mechanism terminated without explanation.90

We can’t close without talking about gold’s kissing cousin—silver. The silver market gets its share of muggings and sustained bashings, at times spanning several weeks. The silver sellers didn’t get full traction either, however, bringing silver off a 50% gain but leaving it up 15% year to date. Silver market treachery got some attention. The London Silver Fix—truth in advertising—at times deviated markedly from the spot price,91 causing consternation among those attempting to fix the price. Deutsche Bank agreed to settle litigation over allegations it illegally conspired with Scotiabank and HSBC Holdings to fix silver prices at the expense of investors.92 A class action suit against Scotiabank suggested that the conspiracy spanned 15 years.93 JPM was cleared of silver manipulation in three lawsuits—all dismissed with prejudice, an altogether different form of “fix.”94 The only remaining question is why they are stockpiling huge stashes of physical silver.95

I’m as sanguine as ever holding large precious metal positions. Gold bugs are reminded, however, of what a big victory will feel like:

“Our winnings will come . . . from the people who wake up one morning to find their savings have been devalued or bailed-in. . . . [I]t’s going to come from the pension funds of teachers and firefighters. The irony is that when gold finally pays off, it will not be a cause for celebration.”

~Brent Johnson, Santiago Capital

Energy

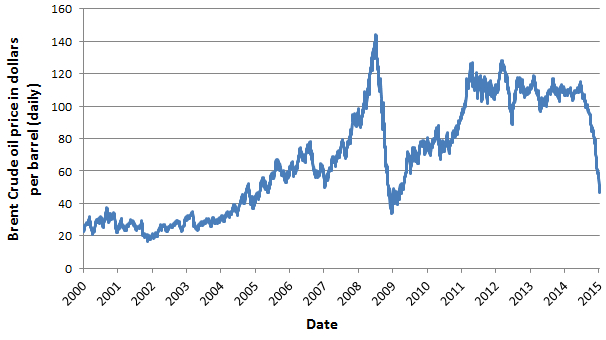

“Why Oil Prices Are About to Collapse”

~Headline from The Oil Drum in January, 2016

You could almost hear the bell ringing on that one. The price of oil promptly went on a 50% rip to the upside. Generally, however, energy was boring (to me) this year, but I keep investing in it. Of course, lower energy prices were hailed as great tax breaks for the consumer, ignoring those who say the economy drives commodity prices not vice versa. Like every other market, however, has been totally financialized. The supply/demand market got replaced with a casino-based futures market, and we know that casinos are trouble. Then there’s that whole petrodollar thingie wherein our alliances in the Middle East keep the dollar at reserve currency status and allow us to sell debt. It also seems to be the proximate cause for bombing vast numbers of Arab countries, but I’m ahead of myself.

A few corporation-specific problems gurgled to the surface. Chesapeake Energy got indicted for energy market manipulation, prompting the CEO to off himself in a one-car accident.96 He probably never realized it was a self-driving car (wink). Petrobras canned 11,700 workers.97 Norway’s sovereign wealth fund started tapping principle because Statoil got crushed.98 Statoil says it will pay a dividend . . . by issuing new shares.99 Maybe it should hire more petroleum engineers and fewer financial engineers. The world’s biggest developer (SunEdison) of the world’s most expensive energy (clean energy) had accrued $12 billion in debt after a two-year asset-buying binge. Liquidation revealed a complex web of Ponzi financing.100

Here’s a funny little nugget for intellectually molesting people at cocktail parties: Edward Longshanks outlawed the burning of coal in 1306 because of pollution. Apparently, Hillary was not the first to try to put a few coal miners out of jobs. Coal is truly hated, and the industry is getting annihilated by the switch to natural gas, which is getting annihilated by fracking-based oversupply.101 The mega-miner Arch Coal got oxidized in the energy rout, ironically leaving little residue.102 It’s probably time to invest in coal miners once the market’s beta corrects. (That’s code for a market-wide sell-off.) All of my ideas are contingent on a prefacing market drop in the throes of a recession. One will come like night follows day, and then the merits of cash will be unambiguous.

Energy companies getting whacked wouldn’t be so bad if it weren’t for the debt. Life insurers have huge energy-based junk bond exposure.103 Of course, the banks will allow them to hang on to greater risk by not calling in their chits rather than face reality. Zero Hedge reported that the Dallas Fed was telling banks not to push bankruptcy on energy companies.104 Denial by the Dallas Fed confirmed the story.105 (Thou doth protest too much.) Wells Fargo is committed to $72 billion if oil companies draw down their lines of credit,106 and that is just the beginning of its problems (vide infra). Wells Fargo, Bank of America, and JPM all have spiking numbers of bad energy-sector loans.107

I keep investing in energy, providing my own little Wall of Money to elevate the markets. In 20 years, I’ll know if it’s a smart move. A subset of this plan includes Russia, Iran, coal, and even uranium. Y’all can keep the new-fangled green energy; it’s too political for my tastes.

“Fossil fuels have saved more lives than any progressive cause in the history of the universe.”

~Greg Gutfeld, Fox News

Real Estate

“7:00 PM Sinkhole forms in San Francisco

7:01 PM Thirty-five people on wait list to rent sinkhole”

~Daniel Lin (@DLin71)

“House prices can’t be in a bubble because they are only 10% greater than the 2006 peak.”

~Seattle Realtor

Thank God the real estate bust is over. That got outta hand fast, but we’ve learned our lesson (sigh.) Of course, it’s not over, and we learned nothing durably. Stupidity doesn’t just rhyme; it repeats. I must confess that I’m unsure how they cleaned up the ’09 bust. Where did the massive inventory go? Some did the full cycle (ashes to ashes). I suspect that many former foreclosures are rentals (Figure 8). Although single-family rentals are a lousy business and represent a dangerous shadow inventory, soaring rental rates may actually make them profitable in the medium term. The authorities also didn’t really clean up the financial mess. Fannie Mae and Freddie Mac—the two toxic government sponsored enterprises (GSEs) that nearly destroyed us in ’09—are being considered for bailouts again.108 What? Didn’t we drive wooden stakes through their hearts? No. They got placed in the government protection program under the pseudonym Karen Anne Quinlan living on Maiden Lane.

![]()

Figure 8. Renter-occupied versus owned houses.

Some bubbles didn’t even burst in ’09. Vancouver real estate went bonkers with the influx of Chinese money. The cost of a single-family home in Vancouver surged a record 39% to $1.2 million by midsummer. Mansions were being bought and abandoned (Figure 9). Shacks (tear downs) were selling for millions. Thomas Davidoff, erudite professor at the University of British Columbia, noted, “These prices are getting pretty freaking nuts.”

![]()

Figure 9. Abandoned $17.5 mansion,109 $7.2 million mansion for sale,110 and $2.4 million starter home in Vancouver.

People were getting rich buying Vancouver houses, but I’ve seen this plot before and know the ending. With everybody on the same side of the boat (boot), it would soon be listing starboard. Is that a blow-off top in Figure 10? Not really. The authorities aggressively scuttled it with a 15% housing tax111 to “cool off the market” (real estate’s version of the ice bucket challenge.) Sales dropped 96% year over year while prices dropped 20% in the blink of an eye.112 Where’d the buyers go? Toronto!113 I suspect Vancouver will retrace a decade (or more) of gains.

![]()

Figure 10. Vancouver real estate prices 1977–2016. Blue is “detached” in so many ways.

Legendary real estate analyst Mark Hanson sees a few frothy domestic markets, too (Figure 11).114 Bloomberg reports that $0 down, 30-year, adjustable-rate, jumbo mortgages are being given to youngsters in Silicon Valley, all backed by stock options.115 The San Francisco Federal Credit Union calls the program POPPY, or Proud Ownership Purchase Program for You because, as Zero Hedge notes, “Steaming Pile of Shit” lacks panache.116 Alan Cohen, former Ithacan and current Florida county planner, told me the Florida real estate bubble was back and bloated. A $95 million tear down in Palm Beach was the sound of a bell ringing.117 Prices of luxury condo sales in Miami have been cut in half.118 A busting golf course bubble is causing problems in Florida and other sand states because the courses are embedded in neighborhoods.119 Smacks of time-share-like legal problems. Some may also recall that a Florida real estate bust prefaced the ’29 collapse.120 Even in New York City the market is softening, as is its bedroom community, Greenwich, CT.117 And $100 million condos are showing evidence of being overpriced.118 Whocouldanode. Aspen witnessed the largest drop—a double-black diamond “freefall”—in years.119

You want some entertainment? Check out this critique of the architectural wizardry behind the ever-popular MacMansion.120

![]()

Figure 11. Domestic real estate markets.

According to Christie’s International Real Estate, $100 million homes were piling up by mid-year.121 It appears that the UK market (especially London) may finally be softening or, as they say at Bloomberg, “tanking.”122 The largest property fund had to stop redemptions.123 Ironically, they’ll have to sell assets, which I’m sure won’t help the market as the virtuous cycle turns vicious. Prime properties have also dropped in Paris, Singapore, Moscow, and Dubai.124 Some say the global high-end market has completely stalled.125 Australia seems to remain in a bubble.126

You know the picnic is over for the commercial markets when the seven-story office building in Figure 12 gets stale on the market.127 The real estate bears have taken notice. (That was inexcusable.)

Debt

“Every cycle in human history has ultimately come to an end. Credit-enhanced cycles come to worse ends than the normal kind.”

~Tad Rivelle, chief investment officer of fixed income at TCW Group

Federal debt has climbed 8% annually since 2000,128 but who cares because we have the reserve currency, can print the garbage at will, and are assured by the highest authorities that inflation is good and high inflation is even better. Meanwhile, friend and market maven Grant Williams has created a masterpiece of analysis of our debt problems.129 In the absence of a deflationary collapse, debt is reconciled to the downside at a geologic pace; it almost never happens. (Supposedly the Brits did it in the mid-nineteenth century.130) The problem is exacerbated by an inherently inflationary banking system that requires monotonically rising debt to survive. Where do you think the interest paid on savings comes from (when there is interest, that is)? Despite the current calm—possibly the eye of the storm—there are newsworthy events in the world of debt.

The consumer is stretched by having no savings and gobs of debt—huge net debt (Figure 13). An estimated 35% of Americans have debt that is more than 180 days past due.131 They are now buying used cars with 125% loans,132 presumably to cover the negative equity from their previous loan and help pay for repairs. The used car market is priced poorly owing to the overdeveloped credit machine created to sell the trade-ins from rentals.

![]()

Figure 13. Consumer debt (credit).

One of the most oppressive of all debts, high-interest credit card debt, now exceeds $16,000 per household.133 The $2500 per annum interest payments are a death spiral for the average consumer earning less than $30,000 per year. The collective tab is nearing $1 trillion.134 Larry Summers blames the high debt-to-income ratio for the stagnant consumer.135 He may be missing the superimposed realization that they have no pension either (vide infra).

“There’s a huge difference between having the money to buy something and being able to afford something.”

~@LifeProTips

Non-dischargeable student loans continue to climb, now exceeding $1.3 trillion (Figure 14). Can anybody picture the millennials paying this off? A comprehensive White House report lays out the stark details.136 Student debt has grown linearly since ’09—suspiciously linearly. In fact, I don’t trust linearities like that:

“A 45-degree angle in finance means one thing—fraud.”

~Harry Markopoulos, Madoff whistleblower

I suspect that the federal government is using student loans as a monetary policy tool to methodically jam money into the system not unlike its bond-buying spree in which Andy Husar was instructed to buy $8 billion a day, every day, without fail. Curiously, the White House (metonymically speaking) thinks “student debt helps, not harms, the U.S. economy.” That idea reflects the IQ expected of a house.

![]()

Figure 14. Just student loans or monetary policy?

There are rumors of arrests of student debtors—Operation Anaconda.137 It sounds like Dickensian debtors’ prisons if true. I think it more likely that we are slowly heading toward some form of debt jubilee. It will be highly politicized and unfairly distributed. Hints of one come in the form of disability relief for almost 400,000 students who are said to be disabled but unable to prove it.138 If, however, ADHD or a damaged frontal cortex that allows one to spend $200,000 on an unmarketable education is a disability, 400,000 is an underestimate. Hillary publically promised to give free tuition to students while privately getting caught on a hot mic referring to the millennials’ hopes of free education as “delusional.”139 This point is now moot.

“Even with borrowing costs at or near their lowest ever, companies are increasingly unable to pay their debts.”

~Mark Gilbert (@ScouseView), Bloomberg

Corporate debt continues to give me fits as companies blow up their balance sheets to buy back shares and pay dividends. This is not self-extinguishing debt. You hear about corporate cash on balance sheets from the media. That cash is stored in metaphorical crocks, because the story is bogus. The top 1% of companies has 50% of the net cash on the balance sheets. (Kinda sounds like the wealth disparity pitch all over again, eh?) Apple, Microsoft, Google, Cisco, and Oracle account for 30% of it. The journalists squealing about “cash to be put to work” often fail to look at the net cash (cash minus debt). Total debt on the balance sheets doubled from $2.5 trillion in 2007 to over $5 trillion by early 2016 (Figure 15). That’s 7% per annum according to the 72 rule (interest rate x doubling time ? 72). Meanwhile the cash on the balance sheet rose by a paltry $600 billion. I get lost in the big numbers, but that is a $2 trillion rise in net debt. They’ve got to keep growing it, however, to buy back shares if they wish to prevent their share prices from collapsing.

![]()

Figure 15. Corporate debt.

Isn’t debt a zero-sum game? We owe it to ourselves? In a sense, yes. But when all this debt comes due, we will discover that our shiftless counterparty (us) doesn’t have any money. All that money you think you’ve saved is owed to the millions of people comprising “ourselves.” How much do we owe ourselves? Unfunded liabilities come to a total of $2 million per viable taxpayer ($200 trillion total). You know what you are owed, but do you know how much you owe to the rest of us? Got gold?

Pensions

“It’s existential. . . . You can pull different levers, but the decline in rates is an existential problem for the entire pension system.”

~Alasdair Macdonald, Willis Towers Watson, an actuarial consultancy

Everybody passes pickles over the social security trust fund when, in fact, it doesn’t exist and never did. It is a mathematical certainty that we will default on our obligations, but it will occur in some way invisible to most people, probably via cost of living adjustments that fail to track inflation, means testing, and just printing money. I signed my wife up for social security early (62) on a bet that they would renege somehow. She didn’t earn much; I did. What started as a small payment turned miniscule. Here is her statement:

![]()

Really? $411 per month was whittled down to $63 per month? The part I cut off was the final clause that said, “Don’t spend it all in one place, bitch.”

The risk is in the substrata of the pension system in which bankruptcy and insolvency are smash-mouth realities. I didn’t mention state debt in the previous section because much of it is hiding as unfunded obligations to pensioners. Paying state and municipal employees with pension promises was such an easy way to compensate people without raising the money. Enter reality: public pensions are now $3 trillion in the hole.140 How long would it take to make up $3 trillion? Noooo problem! Simply pay off a million dollars a day for 8,200 years (assuming 0% interest.) Some examples are in order. Oregon’s public employee retirement system has a $21 billion unfunded liability (6 years of payouts), and it’s growing as returns of 2% somehow fall short of assumed returns of 7.7%.141 Those assumed 7–8% returns have never been accurate over the long term when adjusted for inflation, fees, and taxes. Connecticut, Kentucky, and Hawaii have similar problems.142 Illinois is the gold standard of insolvency. The Illinois Teachers Retirement System is only 40% funded and currently assumes annual returns of 7.5%.143 How did this happen? For starters, the employees are the best compensated in the Union, including free health care for life.144 Wrap your brain around that: they work for 20–30 years and get free health care for up to 50–60 more years? Meanwhile, state labor unions are asking for raises out of “fairness.”

As you drill down, you find bloodbaths pretty much everywhere in municipalities. Chicago’s pensions in aggregate are 20–30% funded depending on whom you ask.145 Pending legislation, however, will allow the insolvent state of Illinois to bail out the insolvent city of Chicago.146

Isn’t there something you can do? Even if we get serious about savings among, say, the boomers, many are way past their fail-safe points. You can hear the barn door slam. At least those with defined benefit pensions are safe because they are protected by contractual obligations. Legal schmegal: there is no god-damned money! Pension cuts are just beginning but could accelerate. The Teamsters’ Central States Pension Fund is looking to cut 400,000 pensions by 55% or go flat broke—zero dollars—by 2026.147 Recent rulings preventing pension cuts are, in my opinion, the courts simply stating that it is illegal to avoid bankruptcy through selective nonpayments. Bankruptcy is about distributing remaining assets in a fair and equitable way to all creditors when there is not enough to go around.

There is evidence of an old-school-style run on pensions: workers are retiring in serious numbers to remove their assets from faltering pension programs. I hear rumors of University of Illinois faculty moving to other institutions—five to Georgia Tech alone—to remove their pensions at full value from the Illinois system while it’s still possible. Dallas police and firefighters are leaving the job to grab their full pensions from a dwindling stash.148 It turns out there was also a bit of a Ponzi scheme going on, which caused the mayor to propose a 130% increase in property tax.149 I don’t see a reelection in your future, Mr. Mayor. As seasoned public servants, they might be able to move to Austin or Houston. There is now evidence the withdrawals in Dallas are being shut down.150 I could even imagine claw backs of the rolled-out funds.

At the personal level, self-directed defined contribution plans paint a clockwork orange big time. Gundlach says the 40–50 crowd is “broke.” Well he exaggerated: the average American household has $2,500 saved, and the average couple consisting of two 45-year-olds has $5,000.151 Technically speaking, they are not broke, but they are totally screwed. Across all working-age families, more than 50% have no savings whatsoever,152 which is one way to render low returns moot. The 55- to 60-year-olds are positioned closer to the pearly gates but have median retirement nest eggs of $17,000.153 Assuming a couple eats six cans of dog food per day (2 × 3) and they have no other bills, the couple will run out of money in 11 years (which, on the bright side, will seem like eternity). The top 10% have less than $300K.154 The numbers could be skewed to the optimistic side: 20% of all eligible 401(k) participants have loans outstanding against their 401(k) accounts.155 This practice is so egregious that some companies are offering alternative payday loans to their employees, albeit with elevated interest rates, of course.156 I remember reading about company towns in West Virginia coal country paying their employees in company scrip. The practice was outlawed.

Of course, I’ve just described a potpourri of anecdotes in the U.S. Maybe it’s better in other countries. Right off our coast we have the tropical paradise of Puerto Rico, which is so up to its ass in debt that creditors essentially own the island.157

“The ECB’s record low interest rates are causing ‘extraordinary problems’ for German banks and pensioners and risk undermining voters’ support for European integration.”

~Wolfgang Schäuble, German financial minister

What about Europe? There’s where it gets fugly. The markets in pretty much everything that is bought and sold are at nosebleed valuations. There is little or no room left for gains through changes in valuation. Interest rates on bonds are miniscule, even negative (vide infra.) You won’t make anything on those bonds, but you could lose enormous principle when—not if—interest rates normalize after a 40-year downward march. There is some evidence that the reversal has now started. Equity markets also have a mean regression in their future despite what the proponents of the mathematically sophisticated Greater Fool Theory espouse. If the markets correct—they always do—you can adjust all those numbers I just cited by an arithmetically simple factor of 0.5. Could an industrial revolution save us? The most stupendous industrial revolution in history—the U.S. juggernaut in the twentieth century—returned an inflation-adjusted 4–5% including dividends using the Dow index as a proxy. Unfortunately, I do not believe those returns are corrected for management fees and taxes. I’m thinking 3% is optimistic. I’m thinking Illinois and the rest of the world are still toast.

Inflation/Deflation

“US deflation is largely a myth, like the Loch Ness monster or North Dakota.”

~@rudyhavenstein, undefeated Twitter Snark Champion

“The debasement of coinage . . . is noticed by only a few very thoughtful people, since it does not operate all at once and at a single blow, but gradually overthrows governments, and in a hidden, insidious way.

~Copernicus

The central bankers and macroeconomists all want inflation. There are media pundits who buy into this metaphysical notion that inflation is good (no offense to the metaphysicists). Dispelling the notion that this quest for inflation is just hyperbole calls for some quotes to capture pundit sentiment:

“I think there is a loss of confidence in the ability of central banks in the long run to regenerate inflation.”

~Ken Rogoff, Harvard professor

“Deflation . . . is bad news because it makes people less willing to borrow and spend—anticipating lower prices, consumers will put off spending—and could also lead to a fall in wages.”

~IMF economist, still waiting to buy an iPhone and flat-screen TV

“All the G7 countries are suffering from a dearth of inflation.”

~Narayana Kocherlakota, former president of the Minneapolis Federal Reserve

“I think they’re heading intentionally for a higher rate of inflation so that once they’ve gotten to, say, an inflation rate of 3 percent, 3.5 percent, that’s when they can jack up short-term rates.”

~Martin Feldstein, Harvard professor and former president of the National Bureau of Economic Research

“Why You Should Hate Low Inflation”

~Time magazine headline

“Welcome news for America’s renters could be unhelpful for the Federal Reserve. . . . Any cooling in the most pronounced driver of inflation means the Fed will have to wait even longer to reach their 2 percent price target.”

~Bloomberg

“Inflation is not at our stated target, not near our stated target, and hasn’t been so in quite some time.”

~Daniel Tarullo, governor of the Federal Open Market Committee

“[T]he ECB needs to signal that it is serious about pursuing its inflation mandate, including via a stepped-up pace of monthly QE purchases.”

~Robin Brooks, Goldman’s chief FX strategist

“The elusive quest for higher inflation”

~Yasser Abdih, senior economist at the IMF

They may believe that by generating small positive inflation levels that seem to accompany strong economic growth, they will somehow create that growth. More likely, they fear no inflation in an inherently inflationary credit-based banking system. If central bankers furiously debase their currencies with an inflationary tailwind and deflation appears nonetheless, then somebody screwed up (them). I buy this latter thesis. Of course, the measure of inflation has been debated ad nauseam in the context of stats rendered dubious by hedonic adjustments, substitutions, unvarnished fraud, and adjustments based on reading goat entrails. I discussed these frauds years ago.158 Inflation is certainly not 2% but some number much higher if one is measuring what Joe Six-pack is shelling out to exist.159 (Anticipating squeals about MIT’s Billion Price Project, I discussed it in last year’s review: I think it’s bogus.)

“The grim reality is that real inflation is 7+% per year, and this reality must be hidden behind bogus official calculations of inflation, as this reality would collapse the entire status quo.”

~Charles Hugh Smith, Of Two Minds blog

The fear of deflation is fear of asset deflation. With huge leverage in the system, a collapse in asset prices becomes insolvency and cardiac arrest. The problem is that the Fed’s inflation policies are the root cause of the deflationary risk. To me, the existential risk is hyperinflation, which is in full bloom in Venezuela160 and germinating in Nigeria.161 Closer to home (for Americans), rents have been soaring—13.2% per year in Boston since 2010, for example.162 Health plans are rising double digits per year, looking to jump more than 15% next year.163 College tuition is on a headline-making inflationary trajectory of 6% per annum above the rate of the admittedly dubious inflation rate.

“The unproductive buildup of debt caused the Great Depression of the 1930s and the Great Recession of 2008.”

~Chetan Ahya, Morgan Stanley

“If businesses and households were to resume borrowing in earnest, the US money supply could balloon to 15 times its current size, sending inflation as high as 1,500%.”

~Richard Koo, Nomura

The Bond Caldera

“The bond market’s 7.5% 40-year historical return is just that—history.”

~Bill Gross, Janus

Sounds a little ominous. He also notes that “global yields are the lowest in 500 years of recorded history.” Alas, there are other bond doomsters. Paul Singer says “the bond market is broken . . . the biggest bubble in the world . . . never-before seen asymmetry between potential further reward and risk.” Former punk rocker and newly crowned Bond King Jeff Gundlach now moves the markets with his pronouncements. Jeff wails that the current market for 10-year treasuries is the worst opportunity in its long history. He calls it “mass psychosis . . . not guided by the markets.” With a little math wizardry that only a bond king could muster, Jeff says, “a 1% increase in the rates would result in up to $2.4 trillion of losses.”164 I’m not sure investors hiding in the safe haven of bonds are quite ready for those losses. They’re betting that rates will never rise 1%. As I type, that is proving to be wrong—possibly dead wrong.

At some point, this party has (had) to end. In 2014, James Grant of the legendary Interest Rate Observer described three bond bulls in America during the past 150 years—“1865–1900, 1920–1946, and 1981 to the present.” The first two did indeed end, and probably unexpectedly given how long they lasted and investors’ willingness to extrapolate to infinity. The third will end too. The bond market is like the Atlantic conveyor that must keep moving currents around the Atlantic Ocean.165 When the conveyor sputters, we get an ice age. When the bond market sputters, we will get the credit market analogue of an ice age.

What’s different this time—a dangerous choice of words—is that the highly financialized markets are not only huge but also highly correlated. The correlation reaches way beyond the conventional debt markets into the shadow debt markets and the $1 quadrillion derivatives market—a quadrillion dollars of the most screwed-up, leveraged investments based on blind faith and confidence the world has ever witnessed. No problemo, say the optimists. We will “net” those puppies. Netting is when you round up investments on each side of the bet and simply cancel them out (like from either side of an equal sign.)166 Ya gotta wonder which genius is going to net $1 quadrillion dollars of derivatives in the midst of a raging inferno. It didn’t work in ’09, and it won’t work the next time, especially in a market so large Avogadro might wince.

“They have to normalize interest rates over a period of two, three, four years, or the domestic and global economy won’t function.”

~Bill Gross

How crazy has the bond market become? The French sold 50-year bonds.167 Ireland sold its first so-called century bond less than three years after it exited an international bailout program.168 Spanish 10-year interest rates are below those of the U.S., prompting James Grant to suggest “a return to the glory of Rome.” The Eurowankers (European bankers) are monetizing debt by buying corporate bonds to jam money into (1) a system that doesn’t need any more, and (2) the pockets of cronies who always demand more. Shockingly, the cronies front-ran the purchase program by buying existing corporate debt169 and creating new types of corporate debt, all for a tidy profit . . . for now. Taking a cue from the U.S. postal service, Japan is offering “forever bonds”: you get interest—a low 1% interest at that—but you never get paid back your principle.170 The idea that inflation will never rear its ugly head seems presumptuous, even preposterous. It would be safer loaning money to your adult children, who will never pay you back either. You know to the penny your return on that investment.

“Bonds are still offering positive yields.”

~CNBC headline

Alas, as is often the case, CNBC isn’t even right on what would be a truism in any other era. I could go on talking about ridiculously low yields, but now we get “the rest of the story.”

ZIRP and NIRP

“It seemed like a good idea at the time: Cut interest rates below zero to revive growth.”

~Bloomberg

On April 1, 2006, an article appeared endorsing zero-coupon perpetual bonds.171 You give somebody your money, and they pay you no interest and you don’t get your money back. Irate readers forced this hooligan to “politely point out to them the date of publication” (April 1st). Did you know the word gullible is not in the dictionary?

Unbeknownst to the author, the article wasn’t satire; it was foreshadowing. There is no endeavor in which men and women of enormous intellectual power have shown total disregard for higher-order reasoning than monetary policy. We are talking “early onset” something. I am not an economist, but my pinhead meter is pegging the needle. Let’s hop right over ZIRP (zero interest rate policy) because it is so 2014 and head right into NIRP (negative interest rate policy). NIRP is where you pay people to lend them money. (Check the date: it’s December, not April.) You heard that right: you give them money, and they give you back less.

“The arrogant, suspender-snapping, twenty-something financial geniuses are yapping in my face. . . . I still can’t fathom ‘negative’ interest rates. It seems the ultimate insanity to say a short sale of a sovereign bond becomes a ‘risk-free’ trade.”

~Mr. Skin, anonymous guru who writes for Bill Fleckenstein

Capitalism progressed for 5,000 years without interest rates ever stumbling on the negative sign (which, by the way, was invented by the Arabs more than a millennium ago). You can no longer simply say that bonds are at multi-century highs; it is mathematically impossible to bid rates on normal bonds into negative territory. It takes a special kind of monetary fascism to create negative rates.

Japan is at the vanguard. Eight days after Hiruhiko Kuroda, head of the Bank of Japan (BoJ), announced he was not considering negative interest rates, he jammed rates negative.172 That was like a knuckleball from the famous pitcher Hiroki Kuroda. Nearly 80% of Japanese and German government bonds are now offering negative yields (whatever “yield” now means).173 Fifty-year Swiss debt has gone negative.174 Early this year, negative yielding global sovereign debt surpassed $10 trillion “for the first time.”175 Really? For the first time? Sovereign debt first dipped below zero only two years ago. An estimated $16 trillion (30%) of sovereign debt is now under the auspices of NIRP (Figure 17).176 Over a half-trillion dollars of corporate debt is also at negative rates.177 Reaching for yield in corporate debt markets always seemed risky, but that’s nuts. By now it could be $1 trillion. I’ve lost track. NIRP has infected the consumer debt market: Denmark and Belgium are offering negative interest rate mortgages.178 (I just soiled my thong.) By the way, you folks with big credit card debt will likely have to wait for relief; your rates are pegged above 20%. Maybe you’ll get some helicopter money.

![]()

Figure 17. Negative yielding debt with a subliminal flare.

These Masters of the Universe, economists and bankers extraordinaire, and their enthusiastic supporters of modern-day monetary theory certainly didn’t leap into the NIRP abyss casually. Let’s listen to the justification in their own voices. While reading, rank their comments as (1) pragmatic resignation, (2) dubious, or (3) delusional rants of the clinically insane:

“If current conditions in the advanced economies remain entrenched a decade from now, helicopter drops, debt monetization, and taxation of cash may turn out to be the new QE, CE, FG, ZIRP, and NIRP. Desperate times call for desperate measures.”

~Nouriel Roubini, professor at New York University

“Well, let’s face it. They can do whatever they want now.”

~Ken Rogoff, dismissing the risk of government taxation by NIRP

“The degree of negative rates introduced by ECB is bigger than Japan. Technically there definitely is room for a further cut.”

~Haruhiko Kuroda, head of the Bank of Japan

“It appears to us there is a lot of room for central banks to probe how low rates can go. While there are substantial constraints on policymakers, we believe it would be a mistake to underestimate their capacity to act and innovate.”

~Malcolm Barr, David Mackie, and Bruce Kasman, economists at JPM

“Negative Rates Are Better at QE Than Actual QE”

~Wall Street Journal headline

“Well, clearly there are different responses to negative rates. If you’re a saver, they’re very difficult to deal with and to accept, although typically they go along with quite decent equity prices. But we consider all that, and we have to make trade-offs in economics all the time and the idea is the lower the interest rate the better it is for investors.”

~Stanley Fischer, vice chairman of the Federal Reserve, based on two years of data on NIRP